Click here to download a PDF version of this guide. Read the full text version below:

This guide is for informational purposes only and does not constitute legal advice.

If you are a surviving loved one or authorized representative (Executor or Administrator of an Estate, and/or Agent under an Appointment of Agent toControl Disposition of Remains form) of a deceased New Yorker who has or will incur expenses for the cost of the funeral, burial or interment of your loved one you may be eligible for financial assistance through one of the below programs.

If your loved one died of COVID-19, as of April 12th, 2021, the most robust and comprehensive program available is Federal Emergency Management Agency’s (FEMA) COVID-19 Funeral Assistance program, which does not place limitations on an applicant’s or decedent’s income, and which covers more types of expenses than any other program. FEMA’s assistance cap is also significantly higher than other programs -FEMA will reimburse up to $9,000 per funeral and a maximum of $35,500 per application if seeking reimbursement for final arrangements for more than one decedent.

If your loved one did not die of COVID-19, there are financial assistance options available where your loved one was a veteran through the United States Department of Veterans Affairs (VA) and/or the New York State Division of Veteran Services, and/or where your loved one had low income at the time of death through the New York City Human Resources Administration (HRA). If your loved one had low income and was also a veteran, you may be eligible for assistance from any or all of the above, so long as there is no duplication of benefits. In other words, these agencies will not reimburse for expenses already reimbursed by another agency.

This information is valid as of April 2021 and all of it is subject to change. If you or the deceased you are making arrangements for are over the age of 60 and reside in NYC, please contact the VOLS Elderly Project & Veterans Initiative at 347-521-5704 if you would like to consult with an attorney.

Federal Emergency Management Agency (FEMA) COVID-19 Funeral Assistance

Beginning on April 12th, 2021, survivors of individuals whose death was caused by, may have been caused by, or was likely a result of COVID-19, can apply for funeral assistance for costs incurred after January 20th, 2020. The applicant must be a citizen, non-citizen national, or qualified alien, and the decedent must have died in the United States, including U.S. territories and the District of Columbia. Applicants should gather the decedent’s death certificate, funeral expense documents, and any proof of funds received from other sources (like HRA or the VA). They should be prepared to provide:

- The applicant’s Social Security number, date of birth, mailing address, and telephone number;

- The decedent’s Social Security number and date of birth;

- The location/address where the decedent passed away

- Information about burial or funeral insurance policies;

- Information about other assistance received, including donations, CARES Act grants, and assistance from voluntary organizations; and

- Routing and account number for applicant’s checking/savings account if seeking direct deposit.

Covered expenses include:

- Transportation for up to two individuals to identify the deceased individual

- Transfer of remains

- Casket/urn

- Burial plot/cremation niche

- Marker/headstone

- Clergy/officiant services

- Arrangement of the funeral ceremony

- Use of funeral home equipment or staff

- Cremation or interment costs

- Costs associated with producing/certifying multiple death certificates

- Additional expenses mandated by local laws/ordinances

FEMA can reimburse the above expenses up to $9,000 per funeral and a maximum of$35,500 per application if seeking reimbursement for final arrangements for more than one decedent as part of the same application. You can apply by calling the COVID-19 Funeral Assistance Line Number at 844-684-6333/TTY 800-462-7585. Call volume is high and callers may receive a busy signal. . If your call was not able to connect, please try calling again later. At this time, there is no deadline to apply for COVID-19 Funeral Assistance. FEMA will communicate a specific deadline once it is established.

Burial Assistance from New York City Human Resources Administration (HRA)

Loved ones of deceased low-income New York City residents that do not have resources or assets available to pay out-of-pocket can apply for reimbursement of funeral expenses, or pre-approval for the cost of a planned funeral from the New York City Human Resources Administration (HRA). Proof of low-income status may include: receipt of social services benefits or public assistance from HRA such as cash assistance, supplemental nutrition assistance program (SNAP) benefits, or social security benefits including supplemental security income (SSI). A legally responsible relative (a spouse or parent of a deceased minor under age twenty-one (21)) that applies for the allowance must also be unable to pay the funeral bill and meet the low-income eligibility criteria to qualify.

Covered expenses include burial, cremation, or interment. As of March 2020 and until June 30th, 2021, survivors can get up to $1,700 for a funeral with costs not exceeding $3,400. If the total funeral bill exceeds $3,400, the cost of the plot, grave opening or cremation will be deducted from the total bill, and where the remaining amount is less than $3,400 the allowance will be approved.

In order to apply, the person responsible for making funeral arrangements must submit a Burial Allowance Application Form M-860W to the Office of Burial Services by mailing it to NYC HRA Office of Burial Services 33-28 Northern Blvd. – 3rd Floor, Long Island City, NY 11101 or by email to BurialServices@hra.nyc.gov; or fax to 917- 639-0476. You can download the form online or request a copy of it by calling the Office of Burial Services at 929-252-7731. The application must be submitted along with the below documents within 120 days of death and will require providing information about the decedent’s assets and financial situation at the time of death. In addition to the application, the applicant should include:

- One certified original copy of the death certificate (which will be returned)

- A copy of the funeral contract (also known as a the Statement of Goods and Services; Selected) signed by both the funeral director and the person that made the funeral arrangements;

- A copy of the cemetery or crematory bill, itemizing all charges;

- Original itemized funeral bill signed by the funeral director and notarized. The bill should be stamped “paid in full” where the applicant is seeking reimbursement;

- Original fully completed funeral director’s affidavit forms signed by the funeral director and notarized, if there is still money owed to the establishment; and

- A W-9 will also be required for payments to an organization or funeral services provider.

Note that during the pandemic, electronic signatures will be accepted. For more information you can contact the HRA Office of Burial Services at 929-252-7731 or visit the HRA website at www.nyc.gov/hra.

Veterans Administration (VA) Death Benefits/Burial Allowance

Whether or not a veteran is buried in VA national cemetery, survivors of veterans may qualify for a burial allowance from the VA, so long as they are not already being reimbursed by another agency and so long as the alleged costs have not already been covered by the VA. In order to qualify:

- The person applying for reimbursement must be the deceased veteran’s spouse/domestic partner, child, parent, or executor/administrator of the estate, and

- Either

- The deceased vet must not have been discharged dishonorably and must have died:

- As a result of a service connected disability, or

- While getting VA care, or

- While traveling with VA authorization and at VA expense to/from a facility for an examination or to receive treatment or care, or

- With an original or reopened claim for VA compensation or pension pending at the time of death if they would have been entitled to benefits before death, or

- While receiving a VA pension or compensation, or

- While eligible for a VA pension or compensation but instead received full military retirement or disability pay

- The deceased vet must not have been discharged dishonorably and must have died:

- Or

- The veteran was receiving VA pension/compensation when they died, or

- The veteran had chosen to get military retired pay instead of compensation

Survivors of veterans who died on active duty cannot apply for burial allowance because those veterans will be buried in a VA national cemetery at the VA’s expense (such that survivors should have occurred no out of pocket costs). Survivors of veterans who died while serving as members of Congress or while serving a federal prison sentence are also not entitled to a burial allowance.

The types of expenses that the VA may cover through the allowance include:

- Burial, which the VA defines as all legal methods of disposing of the veteran’s remains, including, but not limited to, cremation, burial at sea, and medical school donation

- The cost of the plot/interment (unless buried in a national cemetery or other cemetery under the jurisdiction of the United States as the VA already would have covered these costs)

- Transportation expenses where the vet

- Died of a service-connected disability or had a compensable service-connected disability and burial is in a VA national cemetery

- Died while in a hospital/other facility to which they had been properly admitted under the authority of the VA

- Died en route while traveling under VA authorization for the purpose of treatment/examination or

- The veterans remains are unclaimed and will be buried in a national cemetery.

The VA will not pay for funeral director services, including cremation.

Surviving spouses of veterans will automatically be paid a set amount by the VA upon notification of the veteran’s passing (so long as the spouse is listed on the veteran’s profile). Other survivors can apply online or by mailing VA Form 21P-530a, along with supporting documentation, to the nearest VA regional office. To obtain a hard copy of the form and find out which office you should mail the form and other documents to, please call the VA benefits hotline at (800) 827-1000.

The maximum amount of the allowance the VA will disburse depends on several factors.

- For service connected-deaths, the VA will pay $2,000 to survivors of vets who died on/before 9/11/01, and $1,500 to survivors of vets who died after 9/11/01. The VA may also reimburse survivors for part/all of the cost of transporting remains.

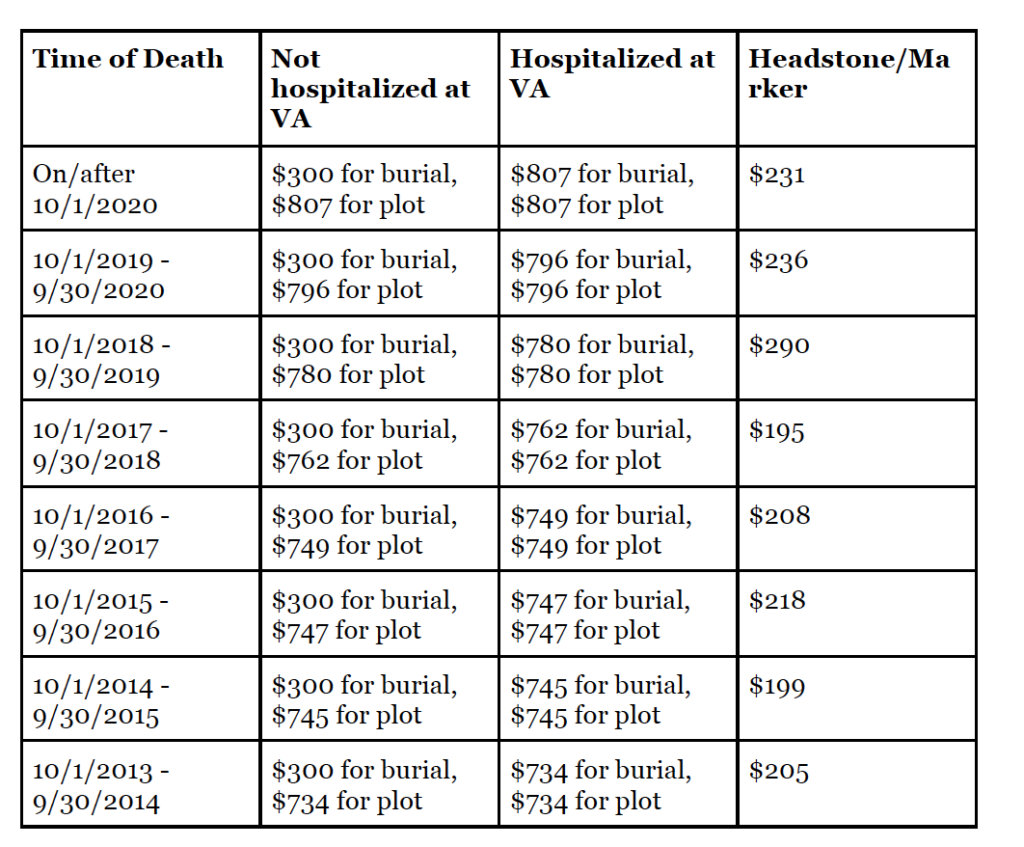

- For non-service-connected deaths, the maximum burial allowance also depends on when, and in some cases, where, the veteran died:

The VA may also reimburse part/all of the cost of transportation of remains for survivors of veterans who were hospitalized or in a VA-contracted nursing home when they died, or who died while traveling to VA-authorized care.

New York State Supplemental Burial Allowance

The state of New York offers a Supplemental Burial Allowance of up to $6,000 to eligible individuals. This subsidy will not cover costs already covered by the federal government ( including FEMA and the VA). Eligible individuals include who incurred part or all of the cost of a service member’s burial/interment and who can prove their relationship to a deceased service member who:

- Was a New York State resident at the time of death OR

- Was a member of the New York Army National Guard or New York Air National Guard when they entered active duty status, and died during service

AND either

- Passed away in a combat zone;

- Passed away while receiving hazardous duty pay per Title 37, Section 310 (A)(4) of the United States Code or

- Passed away from wounds sustained in a combat zone or while receiving hazardous pay.

Along with the application itself, applicants should also gather and submit:

- One document proving the servicemember’s combat-related death (like a casualty report from the military, a death certificate listing cause of death, etc.)

- One document proving either:

- That the servicemember was a resident of New York State OR

- This includes but is not limited to: New York State Driver’s License of non-drive identification card, voter registration, utility bill, residential leas signed within the last year, property tax or school tax bill or receipt from the last year, federal or New York State income tax or earning statement, etc.

- That the servicemember was a New York Army National Guard or New York Air National Guard at the time when he/she entered active duty status, during which period of service he or she died.

- Receipts/invoices for money spent on burial/interment

- Proof of applicant’s family relationship to deceased servicemember

- Documentation of any funds already received from the VA or FEMA to cover costs

- That the servicemember was a resident of New York State OR

Applicants should submit the Burial Allowance application and supporting documentation by mail to the New York State Division of Veterans’ Services, Attn: Supplemental Burial Allowance, 2 Empire State Plaza, 17th Floor, Albany, NY 12223, or by email to dvasupplmentalburialallowance@veterans.ny.gov with the subject line

“Supplemental Burial Allowance Application”. You can obtain a copy of the form, and/or request assistance with filling it out, by calling the New York State Division of Veterans Services at 1-888-838-7697.

This is legal information and does not constitute legal advice, nor is it an offer of representation. This guide was prepared by VOLS’ Elderly Project & Veterans Initiative in April 2021. If you have questions about the information in this guide please contact us at 347-521-5704.